At the Crossroads: Sweden’s Critical Decisions in Gambling Legislation Reform

A significant event has taken place in another European market. The Swedish government is currently attempting to make some changes to the Swedish Gambling Act, with a focus on player protection. However, the Swedish Trade Association for Online Gambling is strongly opposed to some of these proposed changes, particularly tax increases. They warn that these changes could be damaging to the Swedish gambling industry.

The Delicate Balance of Market Regulations

Market regulations are designed to maintain a delicate equilibrium between protecting players and upholding the interests of operators. An excess in favor of operators raises red flags regarding compliance and integrity.

Conversely, overly stringent conditions may not necessarily lead to a safer environment for players. Hence, finding a middle path that guarantees a secure and fair gaming experience for everyone involved is critical.

Source: Which tax-rate yields both high channelization and high tax revenues? by BOS – The Swedish Trade Association for Online Gambling (2016)

Source: Which tax-rate yields both high channelization and high tax revenues? by BOS – The Swedish Trade Association for Online Gambling (2016)

Germany’s experience with stringent regulations serves as a cautionary tale. Focusing predominantly on player protection, the country witnessed an almost complete legal market freeze, inadvertently strengthening the unregulated “grey market.”

It’s important to note the distinct nature of the Swedish and German gambling markets. Since implementing balanced regulations in 2019, Sweden has been steadily cultivating a competitive market characterized by fairness and increasing channelization.

Upcoming Transformations in Swedish Gambling Laws

The Swedish market is on the brink of significant transformations, with government amendments poised to reshape the entire industry.

The amendments, set to take effect from April 1, 2024, include several key changes:

Telemarketing Sales of Gambling Services: A notable amendment is the introduction of a written consent requirement for telemarketing sales of gambling services, aimed at bolstering consumer protection.

Penalty Fees for Money Laundering Violations: The amendments propose aligning the penalty fees for Money Laundering Act violations with those of the Gambling Act, aiming for harmonization and effective crime deterrence.

Increased Powers for Spelinspektionen: The Gambling Inspectorate, Spelinspektionen, will receive new powers, including conducting anonymous test purchases, to ensure compliance with the Gambling Act.

National Sports Confederation’s Role: In the fight against match-fixing, the National Sports Confederation and affiliated sports associations will be permitted to process personal data under certain conditions.

Blocking Payments to Unlicensed Operators: Measures to block payments to unlicensed gambling activities are being introduced, involving collaboration between the Swedish Gambling Authority and payment service providers.

Controversial Tax Increase Proposal

A crucial aspect of the proposed changes is the increase in the gambling tax rate from 18% to 22% of gross gaming revenue (GGR), slated to take effect from July 1, 2024. This move is expected to generate significant additional tax revenue for the government.

However, this proposal has incited controversy within the gaming industry. The Online Gaming Industry Association (BOS) has expressed deep disappointment, with BOS Secretary General Gustaf Hoffstedt criticizing the plan:

“We assess, unlike the government, that the consumer is sensitive to price increases, at least for certain gambling products, such as online casino. A price increase is a likely consequence of a tax increase,” Hoffstedt assesses, referencing a BOS report that challenges the government’s calculations on price elasticity.

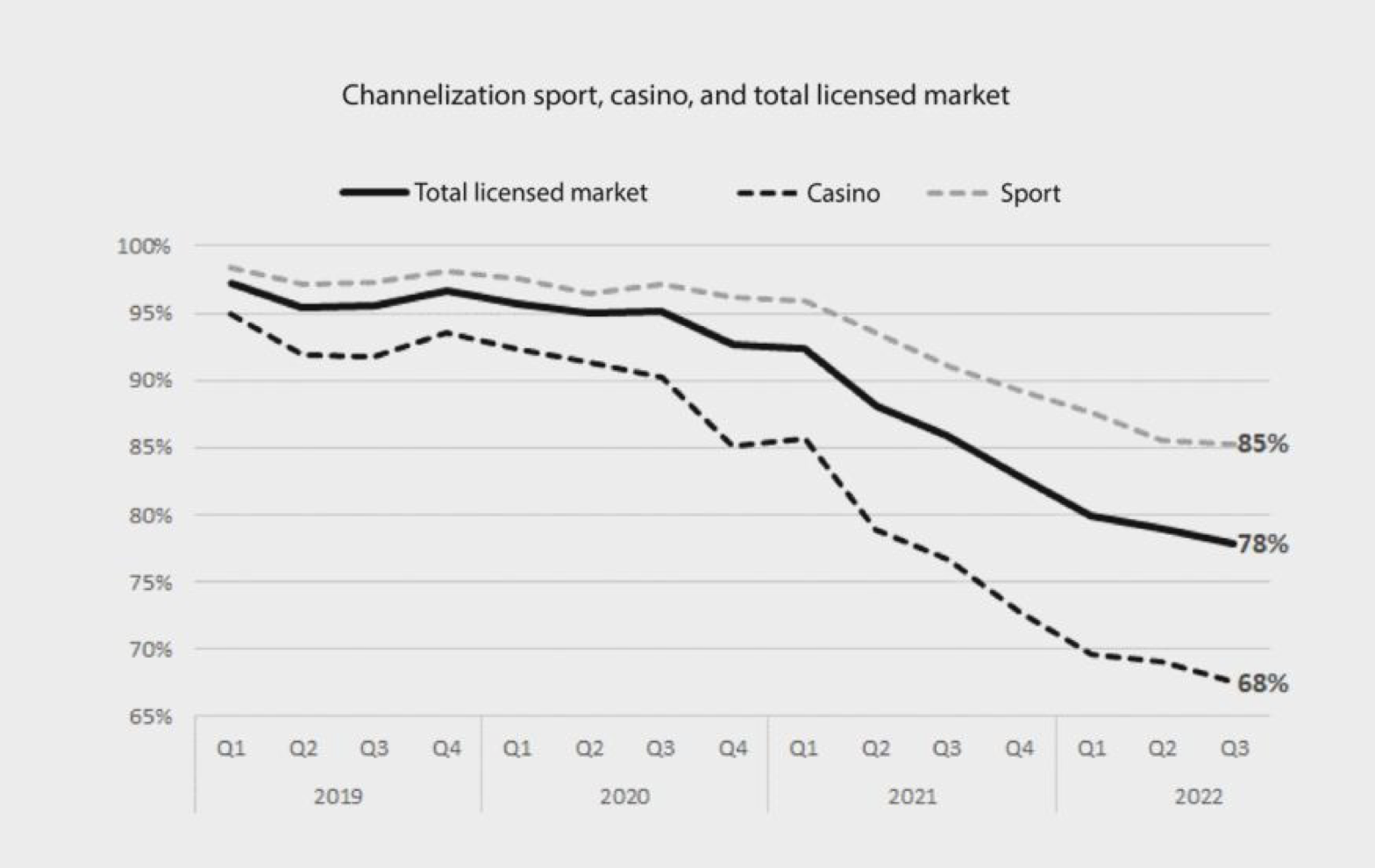

BOS’s research suggests a critically low channelization rate in the Swedish gambling market, particularly in sectors like online casinos.

Source: Referral statement Fi2023/02665, Increased gambling tax by BOS – The Swedish Trade Association for Online Gambling (2023)

Source: Referral statement Fi2023/02665, Increased gambling tax by BOS – The Swedish Trade Association for Online Gambling (2023)

“When the state has reported a channelization of 90% or more, it has included physical land-based gambling that is protected by a monopoly, such as scratch lotteries. But even when these have been excluded, the state has reported a fairly high channelization rate, though never 90% or more. During the period 2019-2021, the state believes that the channelization for gambling within the competition segment (all gambling except gambling products within the monopoly) was between 85-88%,” Hoffstedt told iGaming Express.

A Market at the Crossroads

The ongoing debate reflects a broader conversation about finding the optimal balance between taxation and market regulation in the gambling industry. It focuses on the impacts on licensed operators and the overall health of the gambling market in Sweden. Hoffstedt warns that increased taxes could adversely affect the entire market:

“The only stakeholder who can reasonably welcome a tax increase for licensed gambling is the unlicensed gambling market, which, all things being equal, gets yet another competitive advantage over the legal and safe gambling on the licensed market. As a consequence of the expected migration from licensed to unlicensed gambling, we expect increased societal costs due to the resulting increased gambling addiction,” he concludes.

Looking Ahead: The Swedish Gamble

As Sweden stands at this regulatory crossroads, the decisions made here could be a blueprint or a cautionary tale for other nations grappling with similar issues.

The effectiveness of these reforms will be closely watched, not just by industry experts but by governments worldwide. Will these changes fortify Sweden’s gambling market, or will they inadvertently boost the shadowy realms of unlicensed gambling?

Only time will tell, but one thing is certain: the stakes are high, and the world is watching.