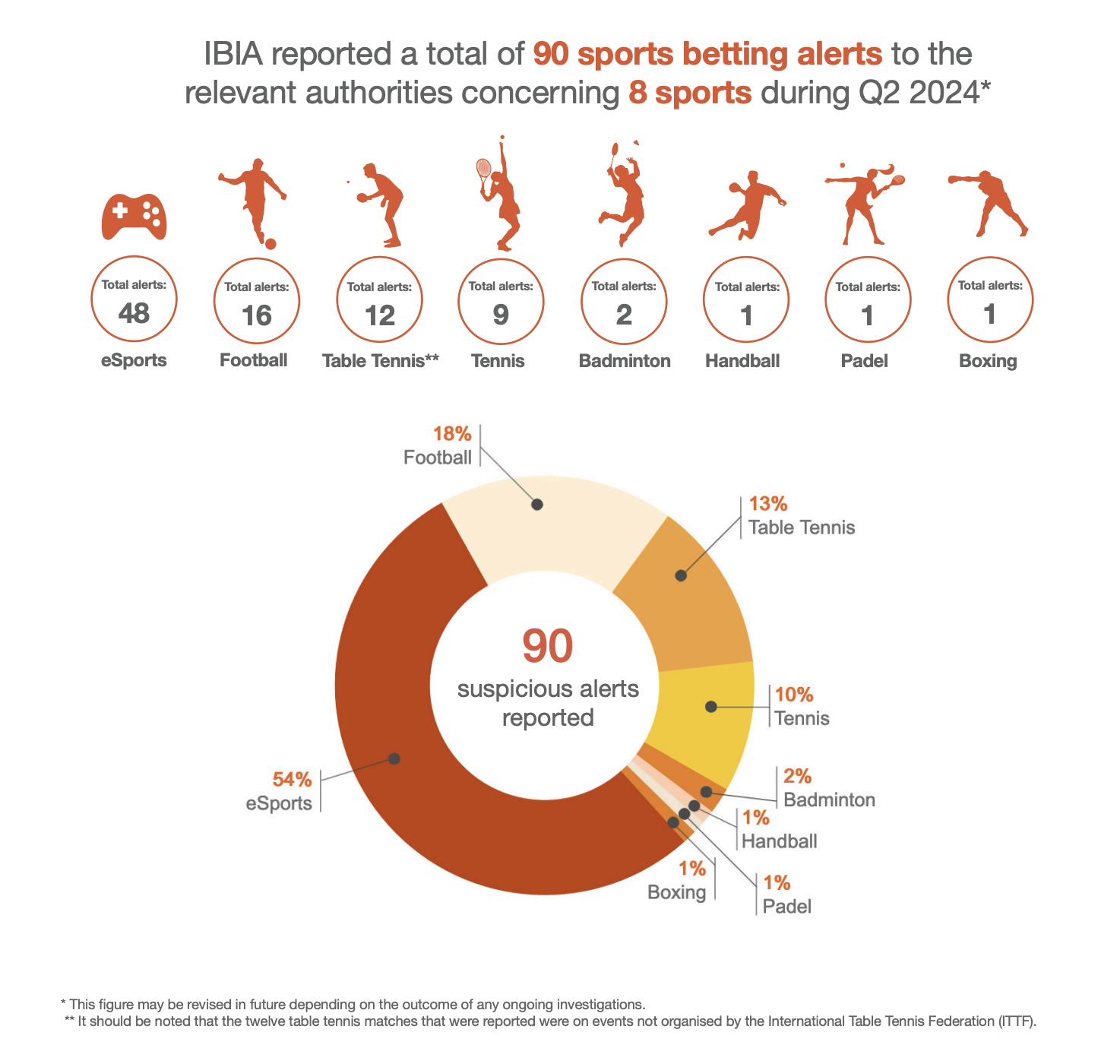

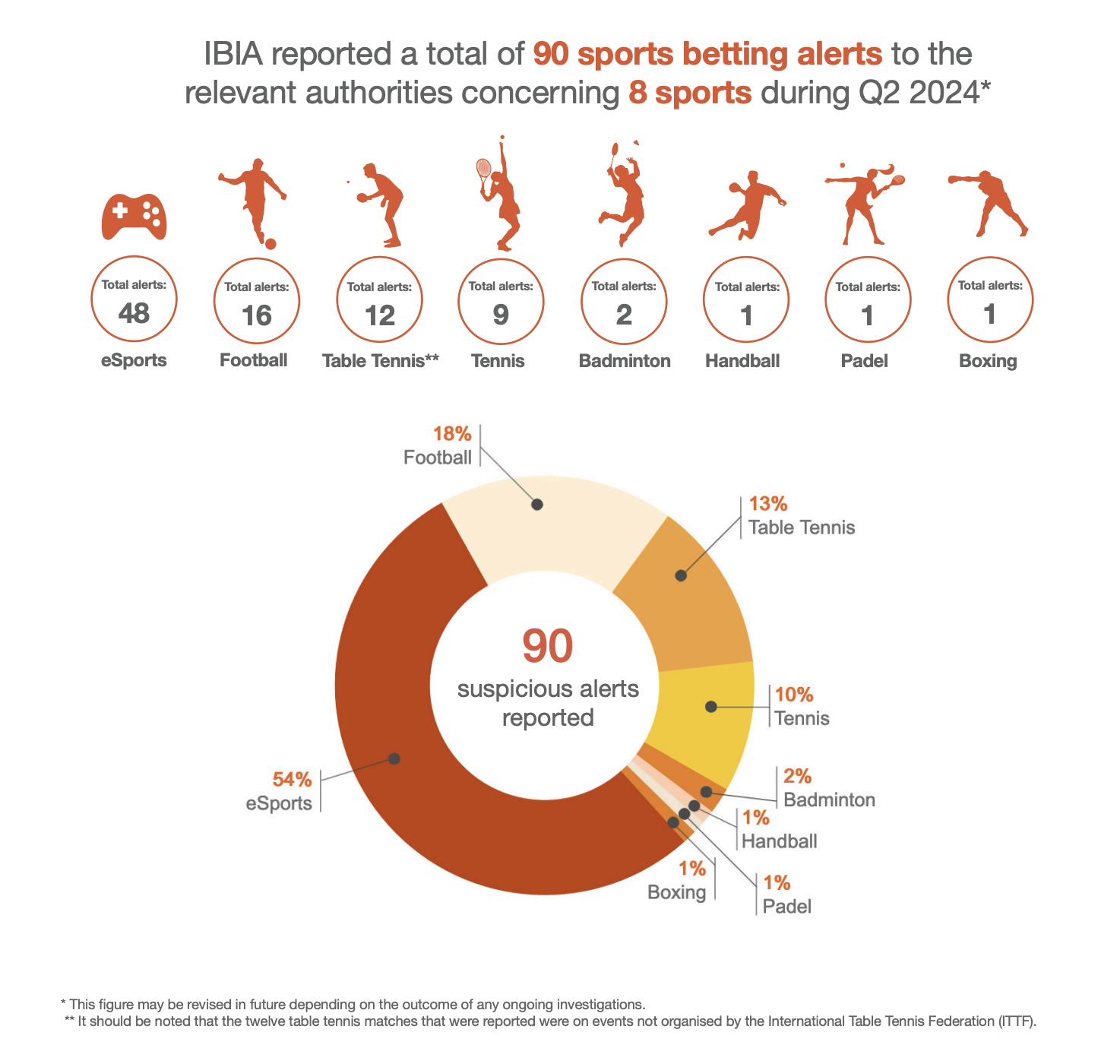

eSports Leads with Highest Number of Suspicious Betting Alerts

IBIA, which oversees over $300 billion annually in betting turnover across more than 125 sports betting brands globally, continues to be the largest entity of its kind. The 90 alerts in Q2 spanned eight sports across 25 countries on five continents.

Three sports—eSports, football, and table tennis—accounted for 84% of the total alerts. Notably, eSports alone contributed about 50% of the alerts, primarily due to a single linked case that also influenced the revised Q1 figure of 43 alerts.

Poland Records Six Suspicious Betting Alerts

Poland emerged with the highest number of country-specific alerts, totaling six cases. Europe saw a notable increase in alerts, with 19 cases in Q2 compared to just four in Q1 2024. However, this was a decline from the 31 cases reported in Q2 2023.

IBIA CEO Khalid Ali commented on the trends: “An increase in the Q2 and revised Q1 alerts compared to previous quarters is primarily related to a linked case in eSports. The situation is being monitored closely and heightened vigilance advocated as we seek to work with stakeholders to investigate.”

He added: “While the increase in alerts may understandably draw attention, it should be noted that eSports saw a significant reduction in annual alerts across IBIA’s membership in 2023. The case again highlights the importance and effectiveness of customer account monitoring in the detection of suspicious betting and the protection of sporting events, consumers, and regulated betting markets.”

Brazil’s Emerging Betting Market

In its Q2 integrity report, IBIA highlighted Brazil’s emerging market as it prepares to open to licensed operators. This market is expected to handle $34 billion in betting turnover onshore, generating $2.8 billion in taxable revenue by 2028.

IBIA has advocated for other Latin American jurisdictions to adopt Brazil’s regulatory framework and integrity provisions, which mandate that licensed sports betting operators join an independent integrity monitoring body.

The increase in suspicious betting alerts underscores the vital role of integrity and vigilance in the betting industry. As IBIA’s extensive monitoring and reporting efforts demonstrate, detecting and addressing suspicious activities is crucial for maintaining fair play and protecting both consumers and the market.