Bettormetrics Reveals Substantial Revenue Losses for Sportsbooks Due to Poor Suspension Strategies

A recent study conducted by Bettormetrics, an AI-driven data company specializing in the sports betting industry, has uncovered that major sportsbooks are losing significant revenue due to inefficient suspension strategies during Premier League football matches.

Bettormetrics’ research

Bettormetrics’ research has shed light on the scale of financial losses suffered by some of the world’s largest sports betting operators, owing to inadequate management of suspension times during Premier League fixtures.

The analysis, which examined key performance indicators across 40 matches and eight major sports betting platforms, found that inefficiencies in suspension strategies led to significant missed wagering opportunities.

Correlation Between Uptime and Revenue Loss

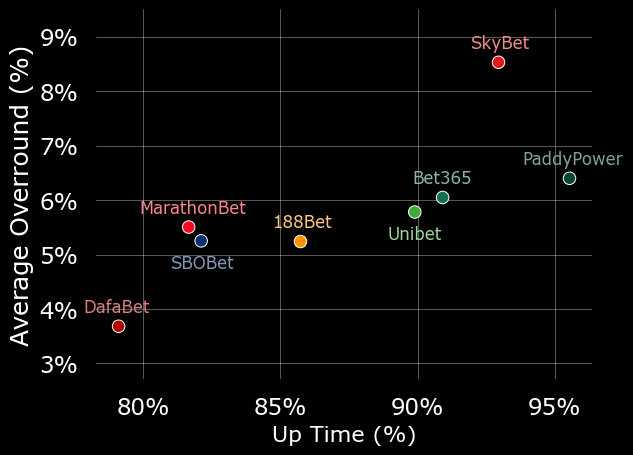

The study analyzed critical KPIs such as Uptime, Overround, Unmatched Suspension Duration, and Arbitrage Duration to determine the impact of suspension strategies on revenue.

Among the findings, a strong correlation was observed between uptime—the period during which betting markets remain active—and overall margins for bookmakers.

According to Bettormetrics, Flutter Entertainment brands, including Sky Bet and Paddy Power, exhibited some of the highest suspension times, with bet365 closely following suit.

However, these lengthy suspensions come at a cost, with bet365 estimated to lose over €100 million in turnover due to suboptimal suspension management.

In contrast, sportsbooks targeting Asian markets, such as Dafabet and SBOBet, maintained higher uptimes and operated on lower margins. This difference in approach allows these brands to capture more betting opportunities during live matches, although they sacrifice some profitability due to tighter margins.

Revenue Impact on Major Operators

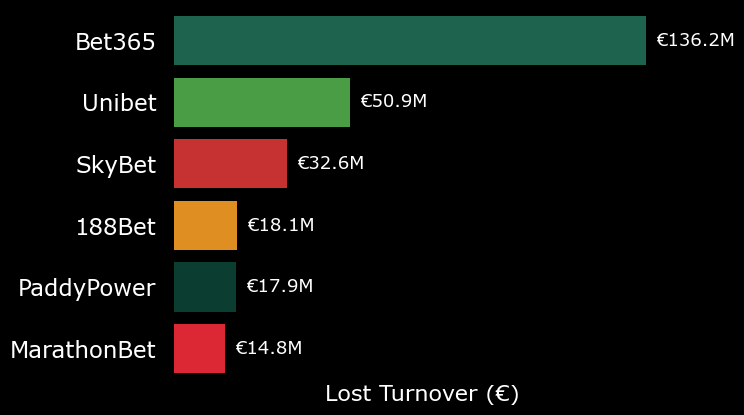

The financial implications of poor suspension strategies are stark, with Bettormetrics estimating that all major operators reviewed are losing at least €1 million in profit per season due to excessive suspension times during Premier League 1×2 markets.

For some brands, the losses are far more substantial. For instance, bet365’s inefficient suspension strategy could cost the operator more than €10 million in real profits each season.

Unibet, another significant player, was found to be losing over €50 million in potential wagers, significantly limiting its ability to gain further market share. Similarly, MarathonBet’s potential losses of €15 million in missed wagers represent a substantial setback for the operator, limiting its ability to reinvest profits into expanding its market presence.

Expert Insights on the Findings

Sabin Brooks, Chief Revenue Officer at Bettormetrics, provided further insight into the effects of poor suspension strategies on operators’ bottom lines. He stated:

“Through our analysis, we’re able to put a hard cash value on the deleterious effects of sub-optimal suspension strategies throughout the Premier League season, and the effect on operators’ bottom line is eye watering.”

Brooks highlighted bet365’s nine-figure loss as particularly notable but emphasized that the impact on smaller operators, such as MarathonBet, could be even more damaging to their overall business.

He added that although suspensions are an essential part of managing live betting markets, especially with factors like VAR increasing uncertainty, sportsbooks need to adopt more refined strategies to minimize their impact.

Robert Urwin, CEO and co-founder of Bettormetrics, also underscored the importance of understanding the nuances of suspension strategies and pricing approaches. He commented:

“By exploring a range of factors, and utilising a plethora of data sources, we were able to extract an array of interesting insights into the performance of operators across the globe, and how suspensions can seriously affect the bottom line.”

Urwin noted that the differences between UK-facing and Asian-facing operators in terms of suspension strategies and margins reveal the importance of balancing pricing and uptime to prevent revenue losses.