Huge potential and opportunities for betting companies. What awaits Brazilian sports betting and when?

The topic of sports betting regulation in Brazil has been stretching for many years, but it continues to electrify both operators and software providers. And it’s no surprise, since we’re talking about a huge market with very high potential. After all, it’s hard to imagine that Brazilians with a good, licensed product wouldn’t want to place bets on their beloved football, or even basketball, which is growing in popularity in the Land of Coffee.

Co-founder of betting software provider Altenar, Dinos Stranomitis, in an interview with SiGMA News, said that there is no doubt that Brazil could be a vein of gold for all sectors of the betting industry: – Once betting is regulated, doing business in Brazil will be much more consistent. I believe the time is already right to be present in this market. Then, when it launches, we will have a competitive advantage.

– I believe that now is the right time to start operating in Brazil concretely and establish an important foundation as a company. I go there often, so I will go there again next week. I want to constantly broaden my knowledge of this market. For Altenar, Brazil did not start today, as we have been increasing our presence in the country for several years – Stranomitis added.

Presidential elections – how did they affect regulation in the Land of Coffee?

In December 2022, significant changes took place in Brazil. Luiz Inácio Lula da Silva became the new president, replacing Jair Bolsonaro in this important position. But it turned out that the former president did not have time to sign legislation to regulate sports betting, which raised serious doubts about the future of the market there.

It is worth recalling that in recent years Brazil has tried to regulate sports betting. The Senate passed Federal Law No. 13,756/2018, which legalized fixed rates sports betting, both stationary and online. The law was passed in 2018, and the government had two years to sign it. In addition, the law includes an item extending the regulations for another two years. The deadline was set for December 12, 2022.

The specific regulations were finally published in May 2022 by the Secretariat of Evaluation, Planning, Energy and Lottery (SECAP) and included a license fee of 4.2 million euros. However, as we mentioned, resigning President Jair Bolsonaro chose not to sign the law, creating another impasse in the situation.

Jair Bolsonaro

Jair Bolsonaro

Such a situation has likely brought the issue of sports betting in Brazil back to starting point. This complicated the issue for international operators, who were not allowed to conduct their business legally in Brazil. As a result, the grey economy has strengthened, which will be difficult to combat, but more on that later in the article.

Andre Gelfi of Betsson said last December that the lack of regulation means that companies operate in legal uncertainty, making them dependent on court decisions.

Unfortunately, there has been another situation in which widespread chaos in Brazil has meant that operators have once again been forced to be patient. However, it is difficult to find another market that teaches as much strength of calm as Brazil’s. Nonetheless, it has such enormous potential that no serious player will give up at this stage.

Taxes – proposed rules and contentious issues

As is the case in any market, the primary contentious issue is tax regulation. Of course, in Brazil, too, there are many doubts among operators as well as lawmakers.

The Brazilian regulator (SECAP) published some of the first new rules on mutual betting as early as the first half of last year. These included the license fee that existing bookmakers, as well as new ones, would be forced to pay.

The government set specific rules on which bookmaking companies operating in the South American country would operate. One of the most important changes was the introduction of a license fee, which must also be paid by entities already operating in the Brazilian market.

It was initially to amount to about 23 million Brazilian reals, or about 4.3 million euros. After time, however, it increased to 35 million RB, or about 6.5 million euros. So, we’re talking about a really considerable amount, even on the scale of the global bookmaking market.

SECAP also announced at the time that licenses will be granted for 5 years and there are no plans to put limits on the number of licenses.

***

Interestingly, however, special requirements have been presented to bookmakers based outside Brazil. They will be forced to establish a subsidiary registered in the South American country and provide evidence of sufficient capital and economic and financial capacity to operate.

The ability to operate will not be determined by a minimum amount of capital. It will be based on the ratio of the company’s share capital and the number of bets taken.

Tax thresholds – who will benefit from the regulations and why won’t it be the football federation?

A tax rate of 16% will be imposed on gross gaming income (the total income generated from all games, excluding winnings paid to players).

Players will also be subject to a 30% income tax on winnings exceeding $425.

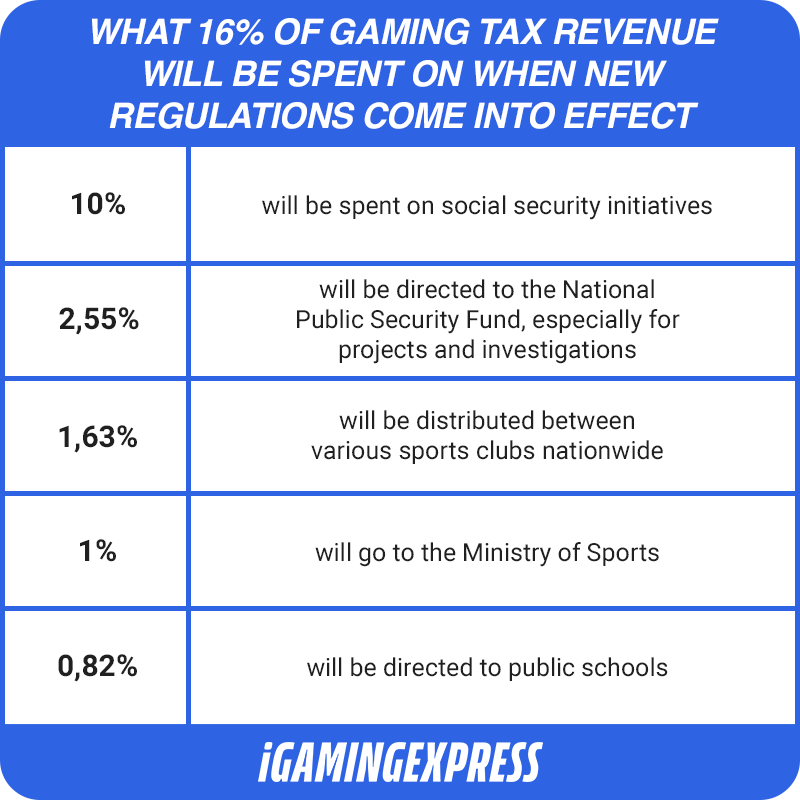

The newly introduced regulations specify the allocation of 16% of the tax revenue generated by these proposals as follows:

Previously, there had been discussions about allocating 4% of the total betting tax revenue to the Brazilian Football Federation (CBF) for the use of image rights by its members. However, this provision was omitted in the current document.

As a result, betting companies operating in Brazil will see an 11 percent increase in their revenue-based tax liability, compared to the initial 2018 legislation, which imposed a 5 percent tax rate.

Won’t the high entry threshold affect the growth of the grey economy?

As we mentioned, the threshold to enter and get a license is really high, even comparing across the global bookmaking industry. At the same time, we are only talking about a license to offer bookmaking bets.

Of course, for the world’s hegemons, paying more than 6 million euros for a license for a market with such a large potential will not be a problem, but for smaller companies it can definitely be.

Well, such a high entry threshold will probably make many companies that can even afford to pay for a license operate in the informal economy. This will give them an advantage over the rest of the stakes, as they won’t pay taxes either – they are now said to have a 15% tax rate on gross gaming revenues.

– We all know what the regulations in Brazil will be. It’s not as bad as we thought at first. However, the government is asking for BR 35 million as an entrance fee for operators. This is an amount of about 6 million US dollars. Unfortunately, this is very costly for some operators and will eventually encourage some offshore companies to continue offering their services.

– When the regulation finally goes into effect, the entrance fee will be a barrier for a large number of operators because it is too high. I estimate that when this happens, we will see up to 15 companies applying for a license. However, I think many other operators will try to continue to operate illegally – said Dinos Stranomitis in an interview with SiGMA News.

Dinos Stranomitis

Dinos Stranomitis

It seems, therefore, that the Brazilian government should listen to the industry once again, as such a high license fee could indeed scare off many operators who decide to stay in the grey zone. In the long term, the regulator will suffer from this, as a large sum of money from gambling taxes will not go to the state budget.

It is far better to regulate the market by controlling gaming taxes than to set a huge entry threshold at the very beginning of opening the market. This is because it will not, as the Brazilian government thinks, eliminate weak operators, but in the long term strengthen the grey economy.

Responsible gaming – rules of responsible gaming

The new rules will allow operators to offer sports and e-sports betting, but bookmakers will be forced to ensure that their offerings are aimed only at adults.

In addition, licensees will have to promote responsible gambling and provide players with information on the subject from the first day of operation, as well as include messages on responsible gaming in marketing messages.

Operators will also have to cooperate with an international integrity monitoring body, such as the International Betting Integrity Association (IBIA). In addition, they will be required to share any data that is sent to the global integrity body.

When will the launch take place?

The above-described proposed changes will undergo an initial evaluation of 60 to 120 days, during which they will be implemented as interim measures.

After this initial period, the evaluation may be extended for an additional 60 days as the changes are thoroughly assessed.

Lawmakers in Brazil will then decide whether to make the regulations permanent, which seems most likely, or to reject the proposed changes altogether, or to revise and make adjustments to the regulations.

The amendments are intended to make significant and comprehensive changes to the landscape of sports betting and related industries in Brazil, providing transparency and removing any ambiguity.

So, all the signs are that the changes should be officially approved later this year or in the first quarter of 2024. Though considering the previous turmoil in the Brazilian market, nothing can be guaranteed.

Will nothing more happen along the way?

One would have to be crazy to think so, because the Brazilian market has already proved to us more than once that things can change 180 degrees overnight.

Let’s consider, for example, that Federal Deputy to the Brazilian Parliament, Ricardo Ayres, filed a bill that would prohibit sports betting on individual stocks of sport events. In the case of football, only the number of goals and results of matches could be bet on.

The provisions of the bill created by Ayres are aimed at protecting the integrity of the games and combating possible manipulation, allowing only bets related to the number of goals scored and the results of matches. Indeed, the MP is investigating patterns of corruption, particularly involving football.

According to Ayres, this approach will prevent negative influences and unsportsmanlike behavior that can occur when betting on individual actions, such as yellow cards, red cards, corner kicks and free kicks. The MP emphasizes that by focusing on betting on the number of goals and results of matches, a safer form of entertainment can be provided that is less susceptible to outside interference.

The MP also highlights the importance of regulating sports betting in ensuring the impartiality of referees and the integrity of sports events as a whole. He points out that betting on individual actions can disrupt the game and lead to harmful behavior. Therefore, it is necessary to maintain fairness, credibility, and transparency in sports competition.

The bill encourages sports event organizers to cooperate with authorities to combat illegal betting activities. It also provides for harsh sanctions under the law, such as fines and criminal-administrative sanctions, in case of violations.

The bill’s provisions also limit the annual amount spent on sports betting to a maximum of 10% of the amount declared in income tax for the last accounting period.

The bill came amid a wide-ranging investigation into match result manipulation in Brazilian football. Earlier, several disqualifications were announced, and Brazilian footballer Nicolas Farias was suspended for 720 days and fined 80,000 Brazilian reals (more than 15,000 euros) for intentionally receiving a yellow card.

This case exemplifies the fact that Brazilian football is struggling with massive corruption when it comes to this game. Unfortunately, this problem is widespread in all sectors of the Brazilian economy, so it will be very difficult to eliminate it in bookmaking. Undoubtedly, it’s also quite a risk, and a challenge for bookmaking operators who will seek licenses in the newly regulated market.

The huge potential of the Brazilian market

Brazil is a tempting piece of cake for almost all operators, as well as other companies operating in various branches of the bookmaking industry, because we are talking about a huge country. As much as five times the size of Argentina, as well as Colombia, which was the first country in South America to regulate betting.

The Brazilian government therefore has a perfect case for how much money can be made from regulated betting in a country with such a large population. In a country where people love football and sports in general. In a country where they also love indigenous sports, which are nowhere to be found in the offshore betting operators operating in the Land of Coffee.

Dinos Stranomitis has no doubt that Brazilians primarily want to bet on local games: – In Brazil, people love local football. I’ve also heard a lot about other popular sports in the country, such as The Ultimate Fighting Championship. However, people love domestic football; it is very much a part of their culture. Everything else is just a supplement.

– When you’re in the sports betting business, you care about every international event, but not the local leagues. Brazil is like many other countries, the locals love local sports. The main thing is that local country-specific leagues will earn more for the online operator than international events – Stranomitis concludes.

Queue to one of the lottery points in Rio de Janeiro

Queue to one of the lottery points in Rio de Janeiro

All of this is to say that it remains to be seen in the coming months, when regulation takes place, just how much potential there is in the Brazilian market.

However, it can already be said that Brazilians’ love for local sports, football, and gambling entertainment is so great that the Land of Coffee will very soon become the most important and largest regulated market in South America. So big, in fact, that it will have nothing to be ashamed of even when compared to Europe or Africa.